PLJPB

-

Posts

202 -

Joined

-

Last visited

Posts posted by PLJPB

-

-

55 minutes ago, smiller14 said:

Agreed. I posted earlier about this on the Trust thread suggesting they ask the club about this

-

Another post with more information has just been posted over on the Plot thickens thread

-

1

1

-

-

-

-

-

2 hours ago, Gav said:

We need a manager who can put this club into the Premiership in the next couple of years, do you think Ainsworth is that man roverandout?

Did you think that man was Mowbray?

-

4

4

-

-

3 hours ago, 1864roverite said:

Its accountability and NOT ownership that is a major issue at Ewood.

But surely its the role of the ownership to ensure/enforce accountability?

-

1

1

-

-

4 hours ago, RoversClitheroe said:

You say you want Mowbray out but weirdly preach about how it's never going to happen. You also defend Mowbray and say it's the Venkys fault.

The Venkys don't setup the team, formation to anything like that for that matter.

He's spent over £15m in his time, handed out countlessly pointless contracts to award a promotion, yet you blame the Venkys? He's the one in the press bigging up the Venkys, recommending contract extensions.

I really don't understand your stand point at all.

I think the point is that it is Venky's fault because they haven't sacked him.

-

4 hours ago, 1864roverite said:

The real way forward to successfully build a base structure and progress. For me that is the immediate removal of Mowbray and a total restructure of the board, putting in place a competent football knowledgeable CEO alongside a board that has vision, creativity and that can think outside of the box, putting its support at the very heart of the club, rebuilding trust and getting the fans to buy into that strategy.

And you believe that Venkys are going to do this?

-

6

6

-

-

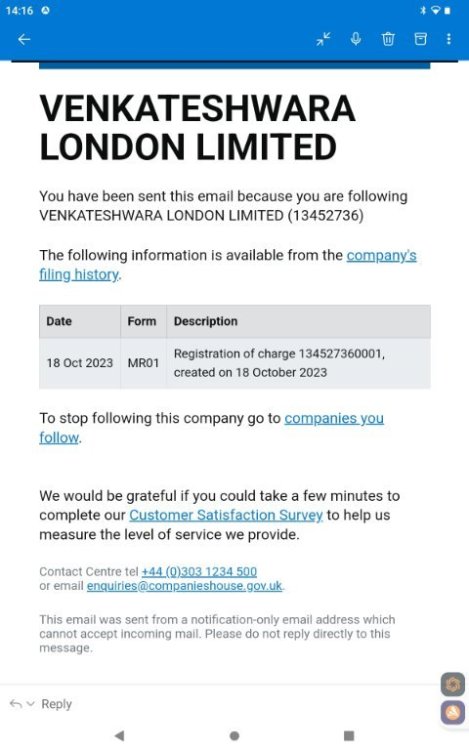

The usual summer cash injection has just been announced at Companies House. £5.250 million into VLL ltd which will presumably be loaned to BRFC ltd as previously done. Total spend by the Rao's on their plaything now stands at £202 million!

There must be cheaper hobbies!

-

5 hours ago, Herbie6590 said:

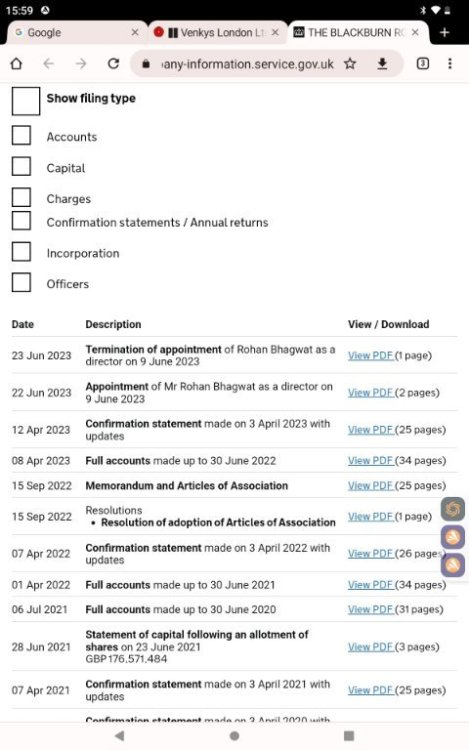

It’s a bit more nuanced Kamy...they tend to convert the debt to shares thereby signalling that it’s a permanent investment in the balance sheet. If it remained as “on call” loans then that might signal a cause for greater concern.

Unfortunately this is technically not the case. The share capital conversions are in the VLL company. Within the BRFC company it is all loans. I.e. VLL can call in the loan and demand payment from BRFC.

Of course that's not to say that the Rao's ever will do this but they retain the legal right to do so.

I've just checked back and the last filed accounts for BRFC show £127m owed to VLL at 30/06/19 within creditors payable within 1 year. There will have been much more loans since then with no share capital changes since then.

-

4

4

-

-

On 25/01/2020 at 17:01, SIMON GARNERS 194 said:

This Circus could go on for decades to come,it really is a gut wrenching awful prospect.

Ewood rots and the debt grows.

It certainly does.

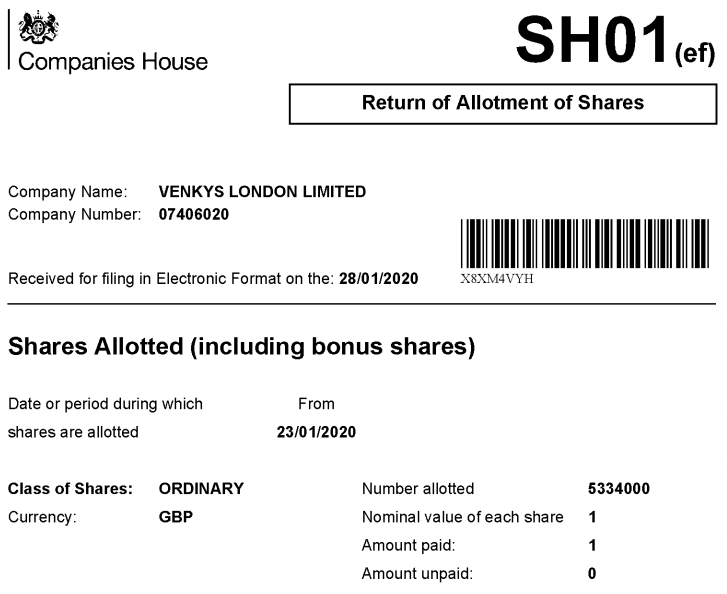

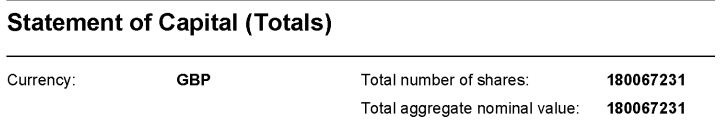

Another share issue of £5.334 million on 23rd January making a staggering total of £180 million spent by Venky's on their 'hobby'.

-

For anyone interested, below are all the cash injections into Venky's London Limited made since it was set up as the parent company vehicle to purchase Blackburn Rovers Football Club.

It starts with the initial £35.6m which off memory was £24m to pay to the Walker trust plus another £11m to cover the overdraft at the time and shows regular payments to keep the club afloat to a current grand total of £174.7m.

My understanding is that all of this cash has subsequently been loaned from VLL to BRFC at a zero interest rate.

£ Issue £ Cumulative 04/05/2011 35,610,000 35,610,000 26/09/2011 3,460,000 39,070,000 10/04/2012 125,000 39,195,000 21/01/2013 24,388,000 63,583,000 12/05/2014 21,039,575 84,622,575 14/10/2014 15,912,500 100,535,075 31/07/2015 22,337,500 122,872,575 19/03/2016 1,085,000 123,957,575 09/09/2016 2,100,000 126,057,575 28/02/2017 666,000 126,723,575 17/05/2017 5,794,156 132,517,731 29/09/2017 6,653,000 139,170,731 11/01/2018 4,700,000 143,870,731 22/03/2018 3,625,000 147,495,731 25/07/2018 4,750,000 152,245,731 16/11/2018 4,812,500 157,058,231 28/02/2019 6,550,000 163,608,231 28/03/2019 1,500,000 165,108,231 01/08/2019 9,625,000 174,733,231 -

1

1

-

-

Just now, Exiled in Toronto said:

Does that mean their share capital in VLL will be on the parent company’s balance sheet at face value, ie as a £127m asset so nothing is showing so far as a loss for them?

Good point that I hadn't thought of. We would have to get a copy of the parent company accounts to be sure. I don't know whether they are publicly available.

If you're correct then they would only suffer a loss if they sold the club for less than the £165m.

-

-

What I find interesting is putting £1.5m in now just one month after putting £6m in.

Are they now working on a hand to mouth, month to month basis or is this a specific need for cash that wasn't forecast only one month ago?

-

24 minutes ago, Exiled in Toronto said:

Excellent and much needed summary. How do they put the money into VLL? Loans from a parent body or share purchases?

The cash has all been put into VLL as share capital. From the last VLL accounts there are no loans and the ultimate parent company is stated as Venkateshawri hatcheries Ltd which is the overall parent company.

At the end of the day it's all the Rao's money but is channelled through their parent company.

-

Another share injection to Venkys London was filed today at Companies House for £1.5m taking the total injected by the Raos to £165m.

There was some disagreement earlier in the thread about how much they had put in - £250m? - but below is my calculation for my belief that it is now £165m. (Its still a hell of a lot of money whether its £250m or £165m!

BRFC (the club) share capital before takeover was £134m (the total cash that Jack pumped in). This was after Jack converted all his loans to share capital.

The initial investment by the Raos into Venkys London Ltd (VLL) in late 2010 was £35m. £25m of this was paid to the Walker family to buy the club with £10m left over to pay off the overdraft (effectively they paid £25m cash for the full £134m of share capital).

This remaining £10m was used to increase the BRFC share capital to £144m in Dec 2010 so that it could presumably be used by BRFC to pay off the overdraft.

There was a further share purchase by VLL on Dec 2015 of 3m taking the total BRFC share capital to £147m which it remains at to this day.

Since the original £35m start up capital in VLL the Raos have put in another £130m taking the total to the £165m I mentioned at the beginning of this (rather long!) post.

All but the Dec 2015 £3m of this I would summise has been loaned to BRFC to keep the club running.

The summary is that the Raos have spent a total of £165m of which £25 + 10 + 3 = £38m was the purchase price and share capital with the remaining £165 - 38 = £127m being a repayable loan from VLL to BRFC which they do not receive interest on but technically could still ask the club to repay. Or they could do what Jack did and convert it all to share capital.

Sorry for the length of the post and all the numbers but this is my take on the cash squandered by the Raos from analysing the Companies House documents filed to today.

-

3

3

-

-

2017/8 season BRFC Ltd accounts now filed at Companies House. The league 1 promotion season came at a cost of a loss of £17 million in the accounts.

-

New filing at Companies House today. Another £6.550 million cash injection into Venkys London Limited which will no doubt be loaned on to BRFC limited as previously.

Total cash outlay by Venkys since day one now stands at just over £163 million with over £16 million being spent in the last 12 months.

-

1 hour ago, tomphil said:

Maybe he's just using the 25 mill per season figure as an average over the time they've been here as I thought the whole point in recent years was to get that figure down otherwise as costs fall there should be a good surplus in the pot now.

Or perhaps that's just the figure that gets written off on the company books per year in India for the club ......

Last 3 seasons cash injections are:

2016/7 £ 8.6m

2017/8 £15.0m

2018/9 £ 9.6m

Source:Companies House Venkys London Ltd Filings

-

52 minutes ago, Ozz said:

Can you provide a source for this info at all. ?

Companies house filing today.

-

Latest Venkys cash input. £4,812,500 paid into Venkys London Limited by way of shares on 16th November which I would assume as previously will now be loaned to the Blackburn Rovers F.C.

Could it be forward planning to enable the first installment on Ben Brereton's transfer or an indication of the size of the January transfer budget? Or could it just be to cover on-going losses?

In any event its now cost the family a grant total of £157 million for their advertising vehicle/hobby/other purpose depending on your own opinions.

-

4

4

-

-

Another injection of cash into Venkys London Limited as share capital according to Companies House. As with previous injections this will no doubt have been passed straight through to the football club as an interest free loan.

This injection is £4.750m following injections of £3.625m in March and £4.700m in January.

Total cash cost to the Raos since September 2017 is £13.075m.

Total cash cost since day 1 is £152 million!

That *was* the January Window

in Blackburn Rovers Fans Messageboard

Posted · Edited by PLJPB

Points already made by previous posts