-

Posts

3872 -

Joined

-

Last visited

-

Days Won

9

Everything posted by Herbie6590

-

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

-

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

The FFP calculation is based on the football club but “related transactions” are excluded to ensure as far as possible a “like for like” comparison between clubs. This means that spending £1m on a top accountant might be a better investment than a centre forward.... modern football. ?♂️ -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Covered higher up in the thread...essentially, yes, it’s a possibility. So using my analogy, it would be like falling out with your mum & dad & them asking for their money back meaning you have to sell the car you’ve just bought & accept that you’re riding a bike for a while...☹️ -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

The losses can be seen in a/cs at Companies House but those accounting numbers are then adjusted for FFP calculations, so you can’t just take the numbers from the a/cs & add them up. Certain transactions are allowed/disallowed to ensure (allegedly) a common standard. This stops Venky’s from circumventing the rules by paying say, £100m for a Venky’s shirt sponsorship deal. That would be a disallowed transaction as it would have obviously have been inflated above market value. Now if you can explain how Man City manage to do it, we might have a path through FFP !!! -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Indeed & this is the conundrum that Waggott & Cheston have to contend with...chase the dream & succeed like Wolves or fail like Sheff Weds/Villa, or accept our place, develop & trade young players, pick up some free transfers & so on...we are back to the standard Rovers 1970’s/80’s business model. The added complexity now is that every year 3 clubs come down with parachute payments which dwarfs our income. Andy Holt at Stanley has a similar challenge albeit on a smaller scheme but his view is to build a sustainable business which operates a football club. Rovers effectively need to do something similar as FFP makes cheque book ownership much more difficult/risky. -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Nice summary...thanks for picking me up on the India issue, never come across that before TBH but there’s always an exception to prove a rule ?? -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Well I thought that & stuck my neck out but it seems I was wrong...? -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Then I stand corrected... -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Me too ? -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

I’ll post this under the heading of “item I never ever thought I’d post on a Blackburn Rovers fan site” ? & I accept that it’s not likely to bring people flooding into the site but regarding the tax benefits of owning multi national corporations... https://www.bbc.co.uk/news/business-20580545 -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

I covered this higher up the thread...the extent of the debt dwarfs what they could ever hope to get from a liquidation. -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Irrelevant to be blunt...all subsidiaries will be grouped up into the ultimate parent undertaking in India...that’s where the final tax computation will take place. -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

You couldn’t be more wrong if you had sat down & tried. Ask yourself why all the major accounting firms have global presences and advise their clients on how to minimise their tax bills across multi national tax regimes. ?♂️ -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Stuart....I’ve absolutely no idea ?♂️ I guess the original intention was to improve brand awareness ahead of a business launch in the UK. They’ve DEFINITELY increased brand awareness globally but I suspect not in the way they intended. Why do they stay ? That depends on your viewpoint - you could argue a sense of loyalty reflecting the mistakes they made & a sense of duty to put it right; you could argue it’s small change & the brand awareness has been worth the investment; you could argue it’s such a small part of their empire, as long as losses are contained, it’s no big deal. I’d bet it’s a combination of all three to varying degrees...and yes, the losses can be offset against global profits in other subsidiaries so it doesn’t cost them the full up figures...but it still costs them... -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Yes -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

It’s debt to the extent that it demonstrates how much we are overspending compared to income, but it’s not debt like your mortgage or credit card bill. It’s more akin to borrowing off your parents. It’s debt, but all parties accept the reality...they’ll not ask for repayment & you’ll never be able to afford to repay ? -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

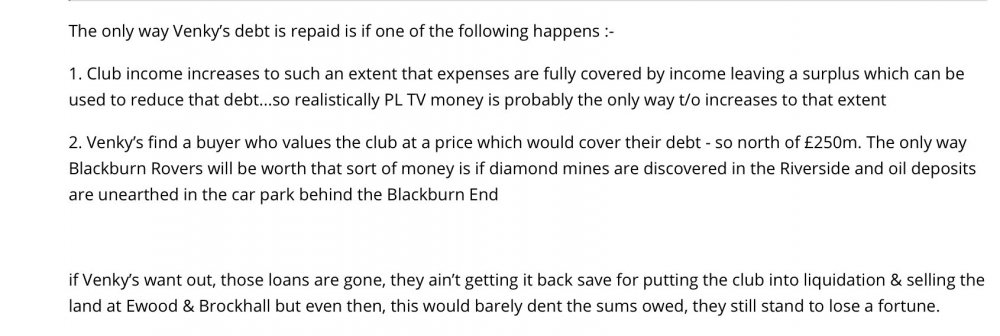

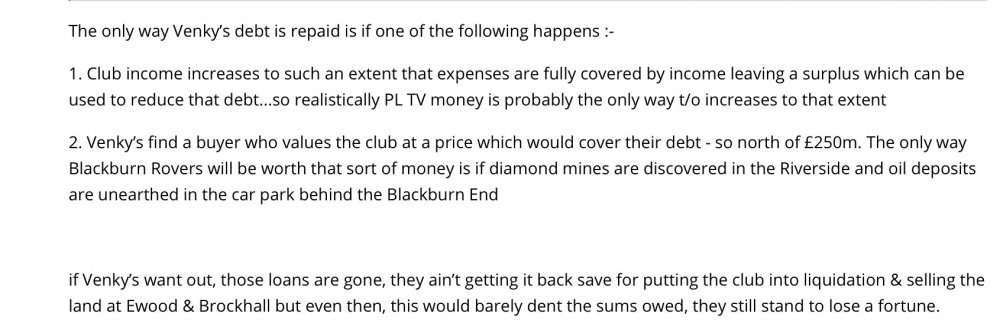

The only way Venky’s debt is repaid is if one of the following happens :- 1. Club income increases to such an extent that expenses are fully covered by income leaving a surplus which can be used to reduce that debt...so realistically PL TV money is probably the only way t/o increases to that extent 2. Venky’s find a buyer who values the club at a price which would cover their debt - so north of £250m. The only way Blackburn Rovers will be worth that sort of money is if diamond mines are discovered in the Riverside and oil deposits are unearthed in the car park behind the Blackburn End if Venky’s want out, those loans are gone, they ain’t getting it back save for putting the club into liquidation & selling the land at Ewood & Brockhall but even then, this would barely dent the sums owed, they still stand to lose a fortune. If there is something to worry about, it is them stopping to fund the weekly shortfall of £300k, because then we would have a distress sale of our players and we’d be operating like Accrington Stanley. Now there is a an argument that at least this would be sustainable and “honest” & to be frank, I have a sympathy with that view. But forget ever returning to the PL. -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

OK, I think I get you; the best example must be Burnley then. They didn’t overspend after their 1st promotion, used the parachutes wisely, maintained sensible budgets and won promotion again, didn’t overspend, were relegated once more and repeated the trick again. if things go to plan, they might get another chance soon.... -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

I’m not sure how you are defining success if you are offering up Blackpool (a basket case club if ever there was, thanks to owners, who ended up in the 4th tier) as an exception; but just considering the last 10 years or so, these clubs have been relegated and bounced back, some more than once, so they must have managed the transition to some extent :- Newcastle Utd Middlesbrough WBA Hull City West Ham Wolves Fulham Cardiff and er....Burnley -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

1. Distress sale of the highest wage earners 2. Relegation clauses inserted into contracts to reduce wages/bonuses 3. Redundancies of non-playing staff 4. Sale of fixed assets (ground, training ground) 5. Securitisation of future season ticket revenue ...all of these have been tried at various times by various clubs... -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Don’t forget FFP rules inhibit what owners can put in. It’s a t/o related formula in the Championship so with low crowds & low sponsorship we are always going to be struggling. -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

They absolutely aren’t, but how many potential suitors with the required financial clout are out there to take this on ? -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

We got relegated & lost TV money. So if Venky’s go, we have to find a new owner willing to cover weekly cash flow deficits or eliminate those deficits. Only two ways to eliminate- increase t/o (profit) or reduce costs to make good £300k per week. Venkys out means an alternative is required. -

Venkys London Ltd accounts

Herbie6590 replied to Pete1981's topic in Blackburn Rovers Fans Messageboard

Accrington Stanley make a profit -

Aren’t these tailored ads which reflect your search history ? ?