-

Posts

6090 -

Joined

-

Last visited

-

Days Won

26

Content Type

Profiles

Forums

Uncouth Garb - The BRFCS Store

Everything posted by Herbie6590

-

Retro Shirts...*LAST TWO NOW*

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

Haha...I'll see if @StubbsUK can add Reminder functionality into the next software upgrade...I'll try my best to manually prompt you before I send the final order to Ribero...😀 -

Retro Shirts...*LAST TWO NOW*

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

Superb…and Thank You 👍🏻 -

Retro Shirts...*LAST TWO NOW*

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

You KNOW it makes sense 😎 -

Retro Shirts...*LAST TWO NOW*

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

It does for me...please try again, if still no joy let me know... https://www.brfcs.com/store/category/1-retro-shirts/ -

Retro Shirts...*LAST TWO NOW*

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

Ideal IMHO...retro chic...😎 -

Retro Shirts...*LAST TWO NOW*

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

@Upside Down You'd better order one now...all this is just for you !!! 😉 -

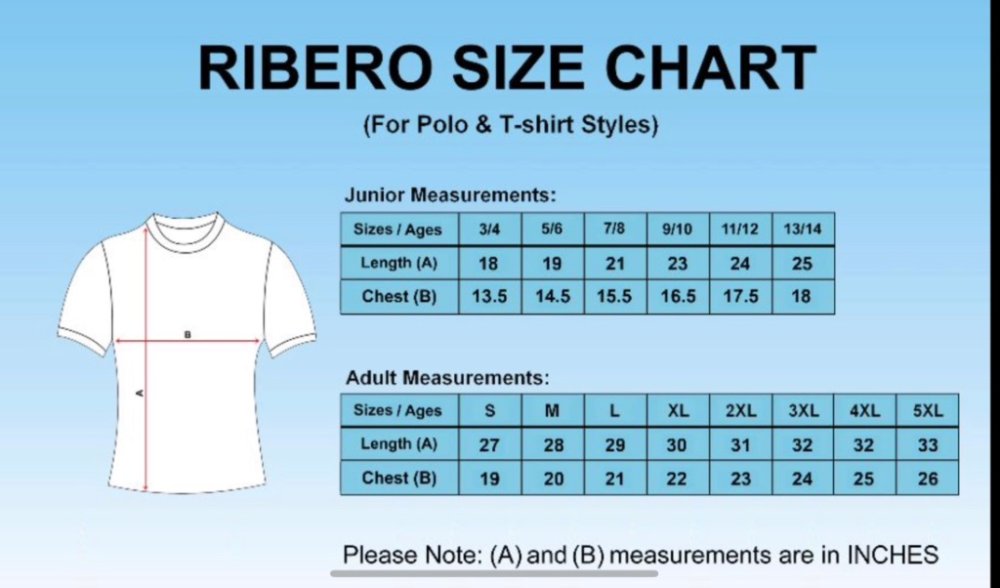

We have great news for all those folks who saw the photos of our 60’s style retro shirts being posted on here last year & thought… ”Why on earth didn’t I order one when they were on sale ?” 😫 We are delighted to confirm that our supplier Ribero can accommodate another order and the really exciting news is that this time, not only are we offering LONG-SLEEVED shirts…we are also offering SHORT-SLEEVED versions - just in time for your spring/summer holidays ! There’s more…not only are all of these available in ADULT sizes…they are now also available in JUNIOR sizes. Just as before, we will take orders for a fixed period (until 1st March at 10pm) & then much like the transfer window…the shirt sale window will slam shut - so place your order in good time to avoid FOMO (I think that’s what the kids call it…). Pricing All shirts will once again be £25 (irrespective of size/sleeve option ordered) plus the relevant postage & packing. For UK addresses this will be £5 per shirt. For Europe addresses this will be £10 per shirt. For RoW addresses this will cost £15 per shirt. How do I order ? Click here to order Please complete the form together, with your credit card details before 10pm on Wednesday 1st March 2023. In the event that the production run is cancelled (for whatever reason) then full refunds will of course be provided & all prospective purchasers will be advised accordingly. When can I expect delivery ? We are looking to place our order with Ribero on Monday 6th March - Ribero have advised that manufacture and delivery to us will take approximately 6-8 weeks from this point. Realistically therefore we are looking at posting out some time from the beginning of May. Posting out the first order last year coincided quite beautifully with industrial action in the Royal Mail 🤷♂️ but we did successfully manage to post every shirt within a week of receipt & whilst clearly no responsibility can be taken in the event of delays beyond our control e.g. container ships becoming stuck in the Suez Canal… Putin declaring war on the UK, that sort of thing…we will do our very best for you… We will of course keep everyone advised of progress via this forum thread. By buying one of these shirts, it demonstrates that the wearer has a finely-tuned sense of what constitutes a classic football design & wishes to pay homage to a different era in Rovers history; and of course It helps us to keep BRFCS running..! Here's that short-sleeve design in use at Ewood... Sizing The shirts will be available in the following JUNIOR & ADULT sizes - the seam to seam measurement “Chest (B)” is probably the most useful to identify which is the right one for you. Please note that the size chart is in INCHES.

-

BRFC - The Nostalgia Thread

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

-

v Watford (a) - 11/02/2023

Herbie6590 replied to Polky's topic in Blackburn Rovers Fans Messageboard

-

Just gutted ....

Herbie6590 replied to sympatheticclaret's topic in Blackburn Rovers Fans Messageboard

-

v Watford (a) - 11/02/2023

Herbie6590 replied to Polky's topic in Blackburn Rovers Fans Messageboard

But they left it in the video…tune in from roughly 30 minutes for some cracking vintage highlights & top quality nostalgia… -

v Watford (a) - 11/02/2023

Herbie6590 replied to Polky's topic in Blackburn Rovers Fans Messageboard

Some podcast preview nonsense from me ahead of Saturday’s game with the lovely chaps from Do Not Scratch Your Eyes podcast… We talked Barry Endean, Sir Roger Jones, Ken Furphy, The Beatles…& occasionally football…but a lot got edited out 😆 -

Yes…but getting 14 to agree is easier…

-

This differs from the UEFA action in as much as “The Premier League” is whatever 14 clubs want it to be…so the line the PL will take will be the one advocated by 14 clubs. I think it will be relatively easy to align 14 (19?) clubs to take a hard line… The worry for the PL clubs is how much they are prepared to spend on legal fees in the courts to enforce it…

-

-

-

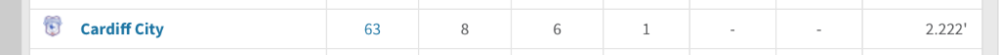

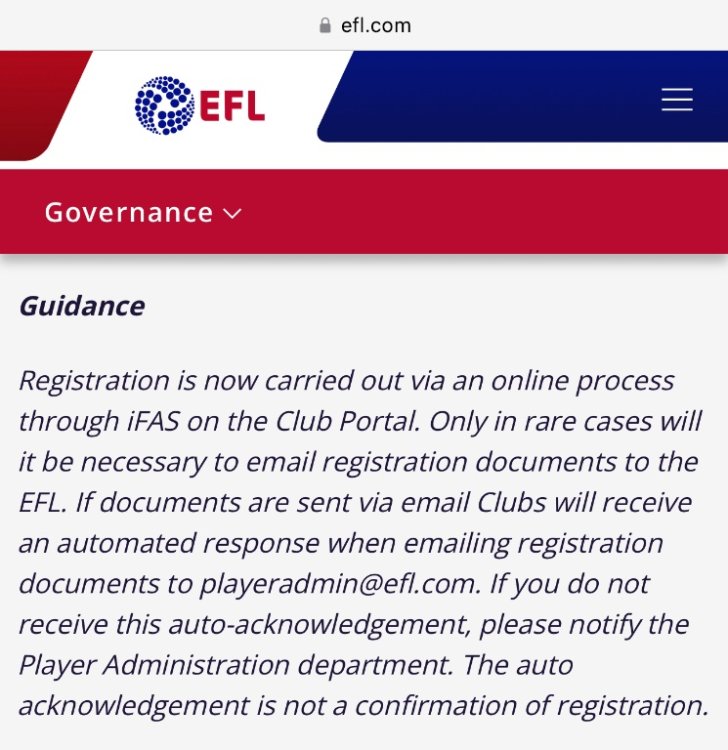

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

-

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

Spot on…And every year that passes the living memory of what could be diminishes… -

Thank you…appreciated. An excellent debut in the hosting chair by @rog of the rovers of this parish. He & [product of our youth policy]@MattGrimshaw7 will take this show forward with vigour..! We have another show “The Round Table” coming out soon…recordings are “in the can” & this will be timeless items discussing things of a more nostalgic &/or whimsical nature. We will be asking for suggested topics on here once the first show is out. 💙🤍

-

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

-

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

-

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

A good journalist never reveals their source… -

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

An interview really should be the absolute basic…his team has royally messed up, communicating & apologising is really PR101. -

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

He’s done what somebody needed to do & take responsibility. I hope that internally he is consistent & doesn’t castigate someone behind closed doors. That would be a really poor show. Should he have at least offered his resignation ? Perhaps…Waggott could always have declined the offer but the risk is that it would have looked stage managed. We need leadership at this football club & frankly, for many & various reasons, SW ain’t up to the challenge. I’d be happier to see Gregg stay & Steve walk frankly.