-

Posts

6090 -

Joined

-

Last visited

-

Days Won

26

Content Type

Profiles

Forums

Uncouth Garb - The BRFCS Store

Everything posted by Herbie6590

-

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

There are multiple headhunting/recruitment companies out there who would take on the brief…& I’m not used to being referenced as an optimist so thank you for that 😆 -

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

Clearly not…other chief executive options are out there though 😉 -

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

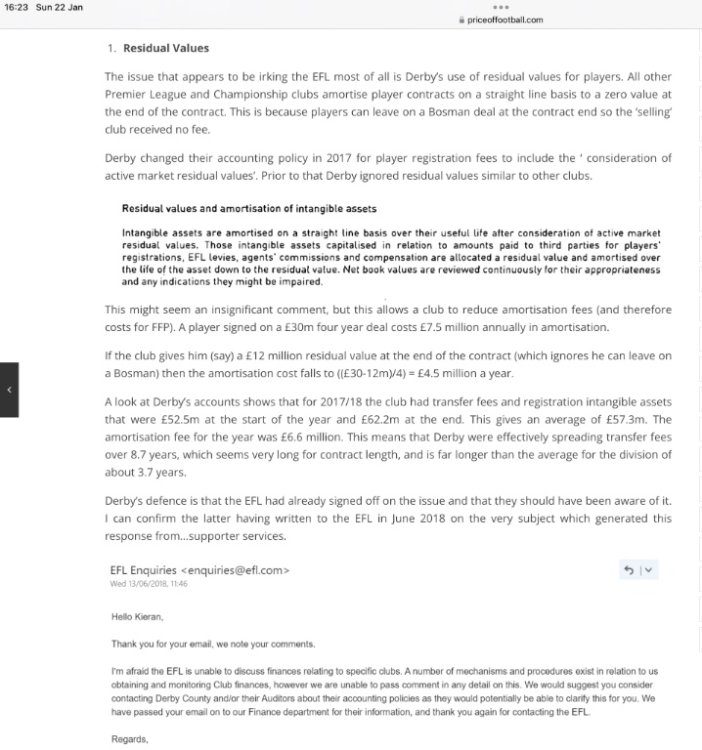

Depreciation. [Crudely] Any business with fixed assets divides the total cost over the anticipated useful life & charges that amount to each year’s profit & loss so that it gives a more accurate reflection of true profitability. e.g. a machine costing £5k & expected to last 5 years would depreciate at £1k p.a. Other more sophisticated accounting explanations are available but that’s the basic idea. For football it massively impacts on FFP calculations. -

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

But they might execute it significantly better..? 🤔 -

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

-

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

Not really…I’m right though 😂 -

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

Mel Morris’s trick was to say (for example) a £10m player on a 3 year deal will be worth say £7m at the end of that deal so we’ll just take £1m p.a. into the P&L rather than the £3.3m every other club would ! Consequently, Derby’s FFP performance was enhanced..! Funnily enough every other club said “hang on a minute..” 😉 -

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

Not so. The fee paid is amortised over the duration of the contract. -

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

Correct…the fee is amortised over the duration of the contract. So long term deals are fine unless/until the player loses form & they want to/need to sell…then the P&L chickens come home to roost ! -

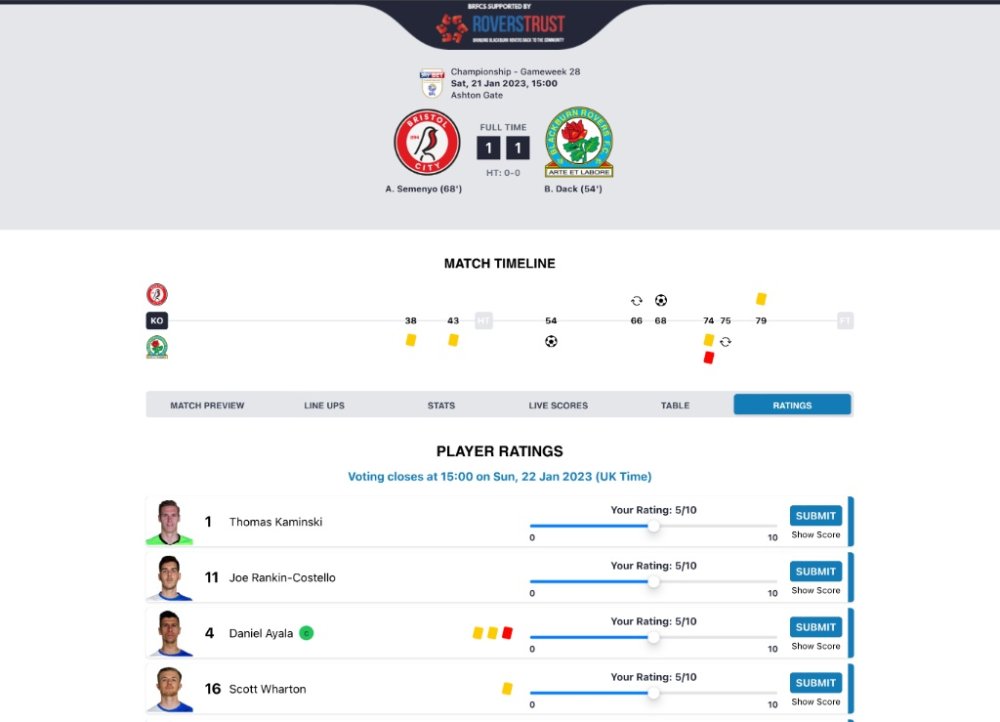

v Bristol City (a) - 21/1/23

Herbie6590 replied to joey_big_nose's topic in Blackburn Rovers Fans Messageboard

-

v Bristol City (a) - 21/1/23

Herbie6590 replied to joey_big_nose's topic in Blackburn Rovers Fans Messageboard

Don’t forget to vote for your MOTM supported by Rovers Trust over in the Match Centre… https://www.brfcs.com/magazine/football/match/881045/bristol-city-blackburn?tab=voting -

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

It matters hugely as it affects our income which affects FFP which affects how much headroom we have to spend. -

v Bristol City (a) - 21/1/23

Herbie6590 replied to joey_big_nose's topic in Blackburn Rovers Fans Messageboard

-

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

Brighton have just sold Trossard so not surprising if they need to bring one in first… -

v Rotherham United (a) - 14/1/23 k/o 12:30pm

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

🤦♂️😆 -

v Rotherham United (a) - 14/1/23 k/o 12:30pm

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

We did discuss on the concourse after the game posting “One Word After Rotherham” 😆 -

v Rotherham United (a) - 14/1/23 k/o 12:30pm

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

It’s where we have possession that is crucial…it’s rarely in the opposition penalty area for sure… -

v Rotherham United (a) - 14/1/23 k/o 12:30pm

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

I think it was Harry Berry (an accountant by trade) who noted on these pages some years ago that Indian tax law precludes losses in the UK being offset against profits generated in India….so even that theory doesn’t hold water…🤷♂️ -

v Rotherham United (a) - 14/1/23 k/o 12:30pm

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

-

v Rotherham United (a) - 14/1/23 k/o 12:30pm

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

Thoughts on brunch, why it’s called New York and abject defending… https://www.brfcs.com/magazine/articles/500-words-after-rotherham-(a)/341 -

v Rotherham United (a) - 14/1/23 k/o 12:30pm

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

-

January Transfer Window.

Herbie6590 replied to Upside Down's topic in Blackburn Rovers Fans Messageboard

-

v Rotherham United (a) - 14/1/23 k/o 12:30pm

Herbie6590 replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard