PLJPB

Members-

Posts

203 -

Joined

-

Last visited

Content Type

Profiles

Forums

Uncouth Garb - The BRFCS Store

Everything posted by PLJPB

-

Venky’s (& Suhail) Out Protest Ideas

PLJPB replied to DuffsLeftPeg's topic in Blackburn Rovers Fans Messageboard

Absolutely nothing would be my guess. -

That *was* the January Window

PLJPB replied to Herbie6590's topic in Blackburn Rovers Fans Messageboard

-

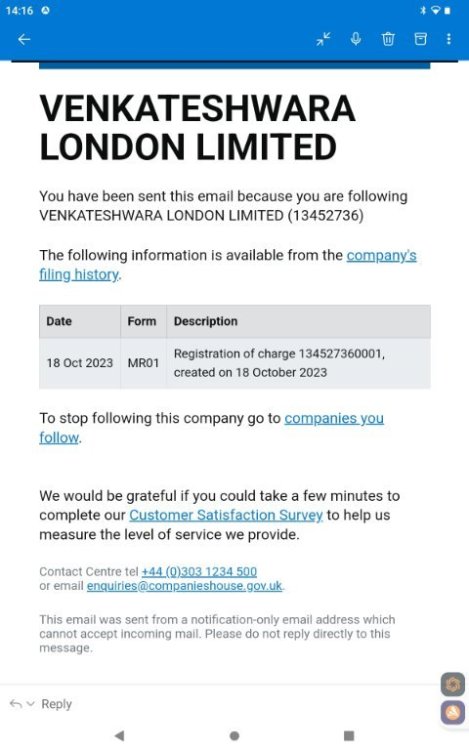

Another post with more information has just been posted over on the Plot thickens thread

-

The finances chap at the trust might want to have a look at this before the next meeting with the club. My initial guess is that this venkys company which was set up to buy the training ground has now borrowed money against said asset.

-

-

v Millwall (a) - Monday 8th May

PLJPB replied to arbitro's topic in Blackburn Rovers Fans Messageboard

Wtf Pears -

But surely its the role of the ownership to ensure/enforce accountability?

-

I think the point is that it is Venky's fault because they haven't sacked him.

-

And you believe that Venkys are going to do this?

-

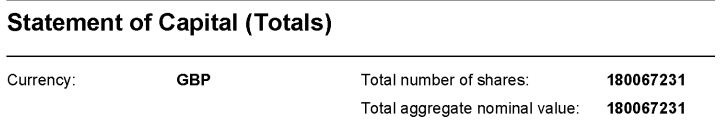

The usual summer cash injection has just been announced at Companies House. £5.250 million into VLL ltd which will presumably be loaned to BRFC ltd as previously done. Total spend by the Rao's on their plaything now stands at £202 million! There must be cheaper hobbies!

-

Unfortunately this is technically not the case. The share capital conversions are in the VLL company. Within the BRFC company it is all loans. I.e. VLL can call in the loan and demand payment from BRFC. Of course that's not to say that the Rao's ever will do this but they retain the legal right to do so. I've just checked back and the last filed accounts for BRFC show £127m owed to VLL at 30/06/19 within creditors payable within 1 year. There will have been much more loans since then with no share capital changes since then.

-

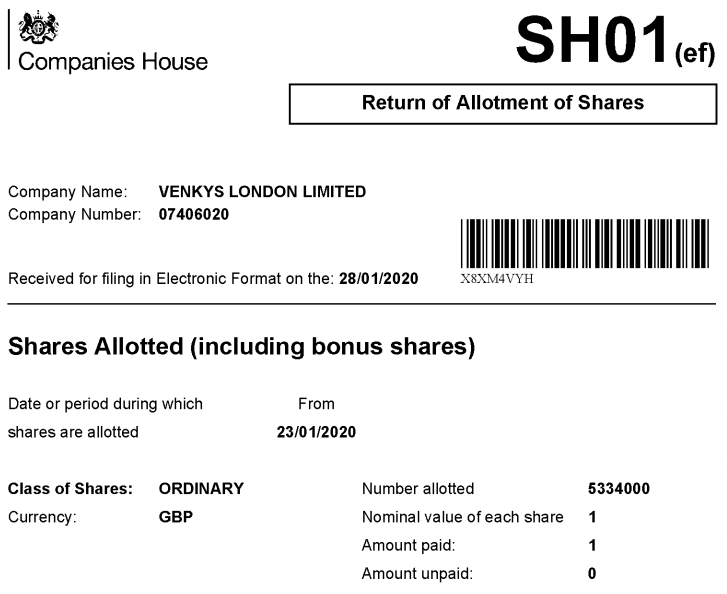

It certainly does. Another share issue of £5.334 million on 23rd January making a staggering total of £180 million spent by Venky's on their 'hobby'.

-

For anyone interested, below are all the cash injections into Venky's London Limited made since it was set up as the parent company vehicle to purchase Blackburn Rovers Football Club. It starts with the initial £35.6m which off memory was £24m to pay to the Walker trust plus another £11m to cover the overdraft at the time and shows regular payments to keep the club afloat to a current grand total of £174.7m. My understanding is that all of this cash has subsequently been loaned from VLL to BRFC at a zero interest rate. £ Issue £ Cumulative 04/05/2011 35,610,000 35,610,000 26/09/2011 3,460,000 39,070,000 10/04/2012 125,000 39,195,000 21/01/2013 24,388,000 63,583,000 12/05/2014 21,039,575 84,622,575 14/10/2014 15,912,500 100,535,075 31/07/2015 22,337,500 122,872,575 19/03/2016 1,085,000 123,957,575 09/09/2016 2,100,000 126,057,575 28/02/2017 666,000 126,723,575 17/05/2017 5,794,156 132,517,731 29/09/2017 6,653,000 139,170,731 11/01/2018 4,700,000 143,870,731 22/03/2018 3,625,000 147,495,731 25/07/2018 4,750,000 152,245,731 16/11/2018 4,812,500 157,058,231 28/02/2019 6,550,000 163,608,231 28/03/2019 1,500,000 165,108,231 01/08/2019 9,625,000 174,733,231

-

Good point that I hadn't thought of. We would have to get a copy of the parent company accounts to be sure. I don't know whether they are publicly available. If you're correct then they would only suffer a loss if they sold the club for less than the £165m.

-

It's just an accountant's way of saying that our genius owners have managed to blow £165 million on their venture into football club ownership!

-

What I find interesting is putting £1.5m in now just one month after putting £6m in. Are they now working on a hand to mouth, month to month basis or is this a specific need for cash that wasn't forecast only one month ago?

-

The cash has all been put into VLL as share capital. From the last VLL accounts there are no loans and the ultimate parent company is stated as Venkateshawri hatcheries Ltd which is the overall parent company. At the end of the day it's all the Rao's money but is channelled through their parent company.

-

Another share injection to Venkys London was filed today at Companies House for £1.5m taking the total injected by the Raos to £165m. There was some disagreement earlier in the thread about how much they had put in - £250m? - but below is my calculation for my belief that it is now £165m. (Its still a hell of a lot of money whether its £250m or £165m! BRFC (the club) share capital before takeover was £134m (the total cash that Jack pumped in). This was after Jack converted all his loans to share capital. The initial investment by the Raos into Venkys London Ltd (VLL) in late 2010 was £35m. £25m of this was paid to the Walker family to buy the club with £10m left over to pay off the overdraft (effectively they paid £25m cash for the full £134m of share capital). This remaining £10m was used to increase the BRFC share capital to £144m in Dec 2010 so that it could presumably be used by BRFC to pay off the overdraft. There was a further share purchase by VLL on Dec 2015 of 3m taking the total BRFC share capital to £147m which it remains at to this day. Since the original £35m start up capital in VLL the Raos have put in another £130m taking the total to the £165m I mentioned at the beginning of this (rather long!) post. All but the Dec 2015 £3m of this I would summise has been loaned to BRFC to keep the club running. The summary is that the Raos have spent a total of £165m of which £25 + 10 + 3 = £38m was the purchase price and share capital with the remaining £165 - 38 = £127m being a repayable loan from VLL to BRFC which they do not receive interest on but technically could still ask the club to repay. Or they could do what Jack did and convert it all to share capital. Sorry for the length of the post and all the numbers but this is my take on the cash squandered by the Raos from analysing the Companies House documents filed to today.

-

2017/8 season BRFC Ltd accounts now filed at Companies House. The league 1 promotion season came at a cost of a loss of £17 million in the accounts.

-

New filing at Companies House today. Another £6.550 million cash injection into Venkys London Limited which will no doubt be loaned on to BRFC limited as previously. Total cash outlay by Venkys since day one now stands at just over £163 million with over £16 million being spent in the last 12 months.

-

Supporters Consultation Meeting - Thursday 21st June

PLJPB replied to J*B's topic in Blackburn Rovers Fans Messageboard

Last 3 seasons cash injections are: 2016/7 £ 8.6m 2017/8 £15.0m 2018/9 £ 9.6m Source:Companies House Venkys London Ltd Filings -

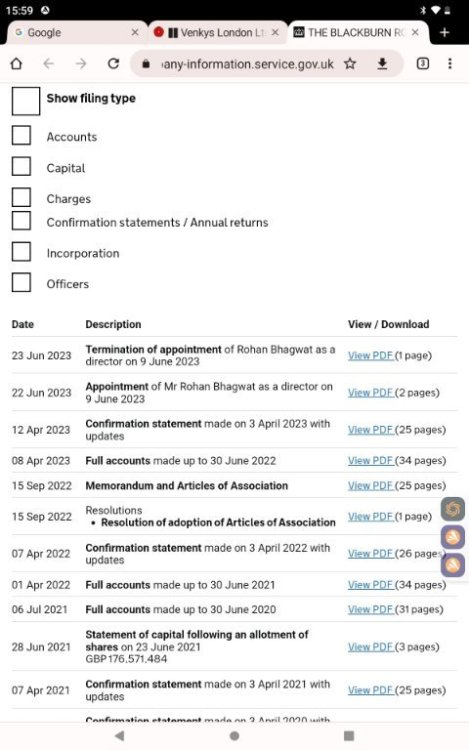

Companies house filing today.

-

Latest Venkys cash input. £4,812,500 paid into Venkys London Limited by way of shares on 16th November which I would assume as previously will now be loaned to the Blackburn Rovers F.C. Could it be forward planning to enable the first installment on Ben Brereton's transfer or an indication of the size of the January transfer budget? Or could it just be to cover on-going losses? In any event its now cost the family a grant total of £157 million for their advertising vehicle/hobby/other purpose depending on your own opinions.